Insurance Customer Service Agent

Glascock & Meenan Insurance Agency – Insurance Customer Service Agent

INSURANCE – Personal Lines Agent – 3 years experience needed for busy insurance agency in Prince Frederick. Must have a Maryland insurance license and computer skills. We offer competitive salary and full benefits package.

Glascock & Meenan Insurance Agency

410-535-0222

How Water Sensors Can Help Prevent Costly Water Damage

If the rubber hose on your washing machine fails, it can cause significant damage to your home. If that leak goes undetected in the basement or another room that you might not regularly visit, the accumulated water can cause potentially catastrophic damage, from moldy walls to warped floorboards. The smart technology in water sensor systems can help quickly alert homeowners of potential leaks and prevent the need for costly and time-consuming repairs.

Water damage is a leading cause of loss in the home. Today, smart technology is helping consumers manage their personal risks. In addition to potentially preventing serious damage, water sensors can also help a homeowner avoid the loss of personal possessions and the hassle of coordinating repairs to your home.

How Do Water Sensors Work?

A water sensor can detect the presence of water, often by measuring the electrical conductivity of the water present and completing a circuit to send a signal. For installations that are not monitored by a professional alarm monitoring company, the sensor and its control module can send out a notification to the homeowner through an app that can be read on a smartphone. If you will be out of town, you can add family members, friends or other caretakers to receive notifications of a leak, so they can quickly prevent further damage.

Some water sensor systems can be programmed to shut off the water to the house to prevent a small leak from becoming a large one. If your home is heated by an older steam heating system, or if it’s protected by an automatic fire sprinkler system, check with a qualified professional before installing a sensor activated water shut off device.

Where Should Water Sensors Be Placed?

In addition to washing machines, failing hot water heaters, leaking dishwashers, damaged supply lines to automatic ice makers and overflowing toilets are some areas where water damage inside the home can occur, often without advanced warning. Performing regular maintenance and checking for rusty, corroded or damaged water supply lines and other potential problems before you have a leak is one of the best ways to help prevent water damage.

Generator Safety

Storms or natural disasters can have the ability to knock your power out for an extended period of time. During an outage, portable generators can offer temporary power, but there are potential risks associated with the use of these generators. Generators can be dangerous, and can lead to illness and injury, and even death if used improperly.

When using a portable generator, it is important to take precautions for your safety and the safety of those in your home. Follow these guidelines for safe generator use:

- Read the manufacturer’s safety and operating manual before using your generator.

- Never leave your generator running when you are away from your home or business.

- Check your generator regularly during operation.

- Use caution when touching your generator as many areas become hot and can burn you.

Be Sure Generator is Connected Correctly to Avoid Electrical Hazards

Electricity supplied by a generator has the same hazards as your regular utility-supplied electricity. You can face additional risks if your generator bypasses safety devices, such as circuit breakers, that are built into your electrical systems. Travelers recommends contacting an electrical contractor or the generator manufacturer for the proper installation of your generator.

- Follow the manufacturer’s instructions for properly grounding your generator to help avoid electrical shock.

- Be sure your hands are dry and that you are not standing in water before touching the generator.

- Never plug your generator into a wall outlet.

- Plug appliances directly into the generator using manufacturer-specified cords or three-pronged extension cords with the proper amperage rating for the intended use.

- Be aware that portable generators become hot while running and remain hot for a significant amount of time after they are shut down, creating a potential fire hazard. Read Full Story

Preventing Slips, Trips and Falls in the Workplace

Slips, trips and falls have the potential to be a major cause of injury for your employees and visitors to your premises. There is a common misconception that slip and fall injuries “just happen” and that there is little that can be done to prevent them.

The potential for slips, trips and falls can be widespread, but it is important to understand where, on your premises, the greatest potential for danger lies.

Some hazards associated with slip, trip and fall injuries include:

- Slippery surfaces, such as a gloss-finished tile, polished stone, etc.

- Holes or broken surfaces.

- Uneven walking surfaces.

- Poorly marked and/or poorly lit walkway transitions.

- Wet surfaces caused by spills or poor drainage.

- Slippery conditions due to mud, ice or water during inclement weather.

Creating a Safe Passage

Routine inspection and maintenance should be a regular part of your safety program to help prevent falls for both your visitors and employees.

- Design your entrances and walkways to accommodate the expected volume of foot traffic through your business.

- Conduct periodic walkthrough surveys of your premises to help ensure your property is kept in safe condition.

- Ensure all walkways are properly lit.

- Maintain all flooring surfaces at all times.

- Use slip-resistant floor treatments, especially in areas proven to be wet.

- Apply floor treatments to manufacturer’s instructions.

- Use “wet floor” signs to warn of known hazards.

- Schedule maintenance of floor surfaces during times of low traffic.

- Have spill cleanup supplies readily available.

- Ensure that entry areas are properly maintained and any mats are secured.

- Promptly investigate incidents, and document findings if an accident and/or injury occurs. Read Full Article

What Is Collision Insurance Coverage?

If you hit another car or object, get hit by another car or object, or your car rolls over, collision coverage will help cover damage to your vehicle, up to the policy limit.

The maximum collision coverage payout is the actual cash value of your vehicle, minus the deductible amount you choose. Be sure to choose a deductible with an out-of-pocket expense you can afford.

You must have comprehensive coverage to purchase this protection. Collision coverage limits and deductibles may vary by state, and is generally required if you have a loan or lease on your vehicle. Otherwise, coverage and limits are optional.

The Impact of Flooding

Flooding can be a devastating natural disaster and, unfortunately, one that is only too common. There’s no good place to live to avoid floods. Any place that gets even rainfall is at risk for flood damage.

The impact of flooding goes beyond simple property damage. Floods can lead to significant economic and social consequences that can last for years. If you live in any area subject to possible flooding, it’s important to understand the risks at hand.

Property Destruction

Property damage and loss of life are among the most serious concerns most homeowners and business owners face from flooding. Floods can cost $6 billion in damage and claim 140 lives annually. And that’s just in the United States. Worldwide, coastal flooding alone accrues costs of $3 trillion or more each year.

Smaller hurricanes and rainstorms – like Hurricane Irene in Vermont in 2013 – can do plenty of damage, including $153 million in state and local costs and $603 million in federal outlays. But, larger weather events, like Hurricane Katrina or Hurricane Harvey, can cause drive up expenses immensely, costing $108 billion and an estimated $65 billion respectively.

Without proper insurance coverage, these costs may be covered by government assistance. But, more than likely, property owners shoulder the financial burden, leaving thousands of families stranded and facing significant costs. Read Full Article

Three of the Most Dangerous Boating Conditions

While spending time near water or on a boat can be an enjoyable way to spend a summer day, some dangerous conditions can exist if you are not properly equipped and prepared to deal with them. Three uncommon, and also avoidable, causes of serious injury include electrocution, being struck by a propeller, and carbon monoxide (CO) poisoning.

Dock Safety and Electricity

Many boat owners choose to keep their boats at a marina as opposed to mooring them. While marinas offer customers a number of amenities, such as water, cable and electricity to charge your boat’s battery or power lights and appliances, one of these perks can also lead to potential hazards. Did you know that stray electrical current from dock wiring or an electrical fault from a boat can energize the water creating an electrocution hazard? In this potentially dangerous situation, a person swimming nearby can become paralyzed by the electrical field and drown, referred to as Electrical Shock Drowning (ESD). Rescuers, when they enter the water, can suffer from the same paralyzing effects as the person they are trying to save. This type of hazard has been reported in fresh water marinas such as on lakes or rivers, but not salt water marinas. Presumably because salt water is a much better conductor of electricity and this can make it harder – but not impossible – for lethal voltage gradients to form.

To avoid this unpredictable and deadly hazard, do not swim or allow your passengers to swim from or near docks or boats where shore side electrical connections are provided. Other things that can be done to help minimize the risk of ESD include:

- Have all electrical work completed by marine electricians certified by the American Boat and Yacht Council (ABYC).

- When selecting a marina to tie up to long term, ask about their electrical inspection, testing and maintenance program, including procedures to minimize the risk of ESD.

- Promptly report to marina management evidence of chaffing cables, tripping of Ground Fault Circuit Interrupters (GFCI) or similar issues with the electrical system and dock pedestals. Read More

Glascock & Meenan Insurance Agency – 50 Years Young

Glascock & Meenan, celebrating over 50 years in business, is located in Prince Frederick at 45 W. Dares Beach Road in the red brick building directly across the street from Safeway. Bedford Glascock started the agency in 1967 and Keith Meenan joined the agency in 1978 becoming president in 1987. We know most of our clients on a first-name basis, and this personal relationship between agent and customer stretches over 5,000 active policyholders. Glascock & Meenan is contracted with over 12 insurance companies, so we can find the best fit for our client. Focus is on a client’s needs, and we will move a client to a different carrier when warranted. We are truly an independent insurance agency and proud to be a member of the Trusted Choice Independent Insurance Agents Association of America.

We have no voicemail. When you call Glascock & Meenan, you will talk to someone immediately; you talk to a real person. We offer personal lines insurance such as home, automobile, boat and umbrella. Our commercial department will work up a package that can include: property, liability, automobile, workers compensation, contractors’ equipment, etc. We will write your life and health insurance as well. Whatever type of insurance you’re looking for, you will get fast personal attention.

This service is from a staff of nine and most of our agents have over 15 years experience with Glascock & Meenan. We have a culture of service after the sale. For example, a client whose auto insurance policy was purchased through Glascock & Meenan was stopped by police. The client was unable to show proof of auto insurance to the officer who had pulled him over. Based on a new Maryland law, the client would have been fined $50. However, a call to his Glascock & Meenan agent led to an email and text which was sent to the client’s phone. The emailed and texted document showed that the driver did indeed have auto insurance and the fine was averted. We use modern technology while providing “old-fashioned” service.

On a periodic basis, Glascock & Meenan agents evaluate a client’s insurance portfolio, and recommend changes as needed. We have invested in technology that allows us to easily communicate with our customers and be proactive. We notify clients when insurance companies make significant coverage changes, and we will suggest options. For example, insurance companies frequently change Hurricane deductibles, a move that sometimes goes unnoticed by clients. We constantly review for any changes and notify our customers. We also encourage our clients to contact us if there are any changes in their lives. For example, if they have children heading off to college or a change in marital status, etc., it’s good to discuss the many insurance ramifications and options.

Being a full service insurance agency, we also provide assistance during the claims process. This intangible product we call insurance becomes real when there is a loss, whether small or not so small. The purpose of having insurance is to be made “whole” again. We take the initial claim call and follow through. Incurring a loss and filing a claim can sometimes be a confusing, overwhelming, or frustrating experience. We are involved during the entire claims process and will intervene with the insurance company, if needed, to get your claim settled.

Glascock & Meenan has long-standing relationships with the insurance companies we represent, and was given a $5,000 grant to use internally or donate to a local charity. We were happy to pass the grant on to the Calvert County Rescue Association Memorial Fund, as some of us are first responders ourselves, and know firsthand their value in our community.

Glascock & Meenan is truly a “brick and mortar” insurance agency that is here to serve YOU, our valued client. For virtually any kind of insurance, call 410-535-0222 to make an appointment with an agent. Walk-ins are also welcomed, Monday through Friday 8:30 to 5. For more information, visit our website at Glascock-Meenan.com.

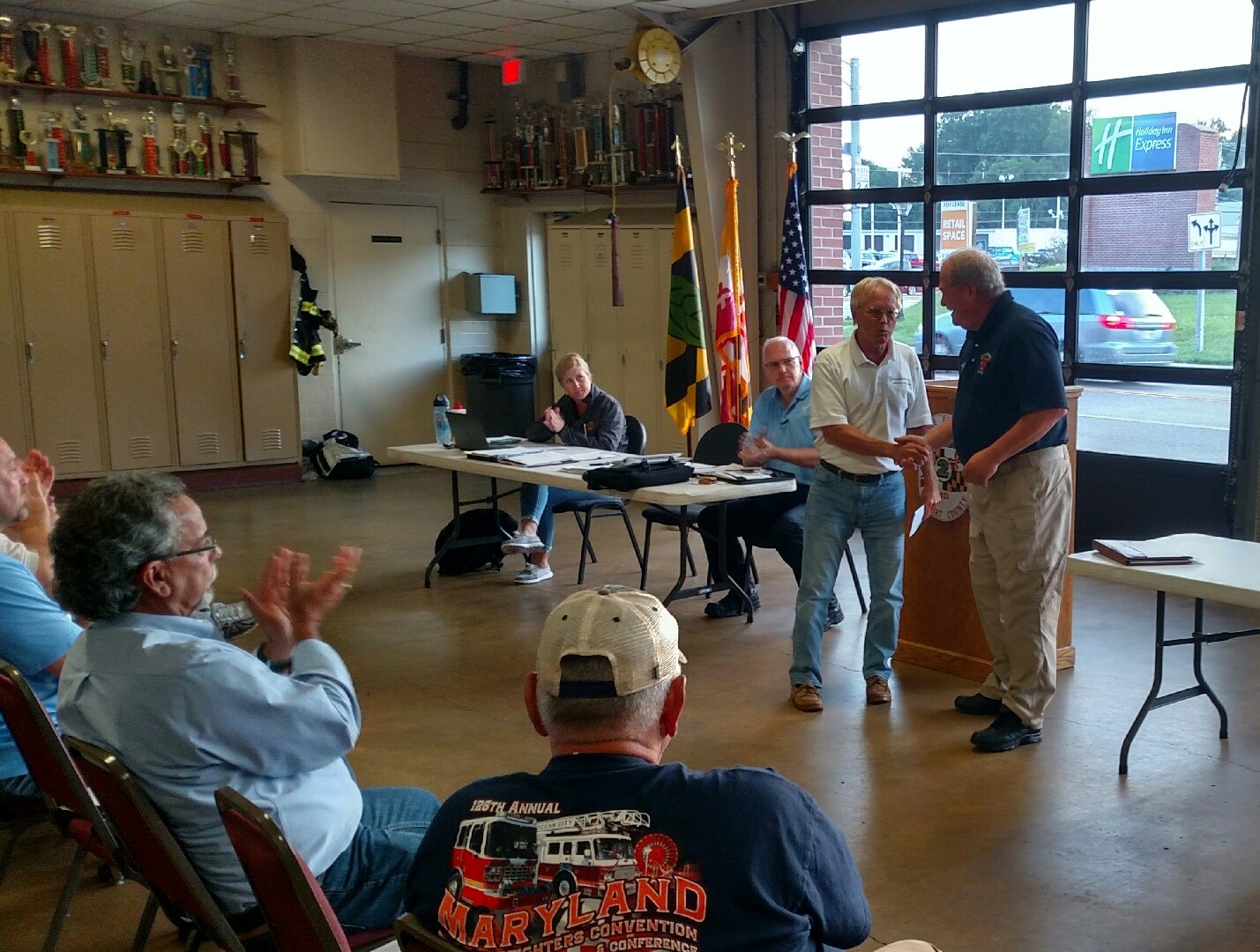

Keith Meenan, President of Glascock & Meenan Insurance Agency (right), presents a $5000.00 check (2018)

Keith Meenan, President of Glascock & Meenan Insurance Agency (right), presents a $5000.00 check to Bill Freesland, Chairman of the Calvert County Fire and Rescue Association. The check is earmarked for their Memorial Fund. At the August 13th association meeting hosted by Prince Frederick VFD, Meenan thanked the members of the Association for their outstanding service and dedication to the community.

The donation is to be used for the families of fallen first responders. There is an inscribed Memorial Monument located on Broomes Island Road in Calvert County, to recognize and honor the services of deceased fire and rescue personnel and their dedicated efforts in protecting and serving the citizens of Calvert County. The Calvert County Volunteer Fire & Rescue Association Chaplain conducts an annual service at the Memorial site to commemorate those who have passed during the year.

The Calvert County Volunteer Fire & Rescue Association prides itself on being an all-volunteer fire and rescue organization. Donations to the Memorial Fund can be made by contacting Calvert County Volunteer Fire & Rescue Association President, Bill Freesland at North Beach VFD at 410-257-6564.

Over the past two years, Glascock & Meenan Insurance Agency has donated $10,000 to the Memorial Fund. Celebrating their 51st year in business, they are located at 45 West Dares Beach Road in Prince Frederick.

Glascock & Meenan Insurance Agency an extraordinary team!

Congratulations to you and your extraordinary team at the Glascock & Meenan Insurance Agency on celebration 50 years of business serving the Southern Maryland community. This is quite an achievement and I applaud your long-term commitment to professional excellence.