10 Ways to Save on Your Car Insurance

Car insurance is a necessary expense for many people, and there are a variety of ways to save on this household cost once you know what it takes. To get started, gather your personal information, determine your budget and then consider the insurance coverage that you think will best safeguard you and your lifestyle.

Here are 10 ways to save on your car insurance:

1. Gather Specifics About Your Car and Its Primary Drivers

One way to begin the process of shopping for car insurance to get the most value for your money is to gather all of the information an insurance carrier needs to offer you the best possible rate.1 Start by compiling this basic information before you shop for quotes:

- Make and model year of your car. You’ll find it on your car’s registration.

- Vehicle Identification Number, or VIN. This is located on the inside of the driver’s side door pillar.

- Your car’s safety features, including lane departure warning system, forward-collision warning and a back-up camera.

- The anti-theft devices you use, including such mechanisms as an electronic tracking device or a steering wheel lock. Along with understanding the anti-theft features, you’ll want to take note of where you will be parking your vehicle. Consider the difference between parking your car in your garage versus parking it on the street or in locations outside of your home.

- An estimate of how many miles you drive annually, plus your home and work addresses.

- A list of everyone who will drive the car, their ages and any driver safety courses they have completed. Many insurance companies also want to know who in your household is of legal driving age, what their license status is (such as whether they have a learner’s permit or a suspended license, for example) and whether other drivers in your household have their own insurance. Depending on the state, this can help the insurance agent determine who should be listed and considered for your quote.

With this information, an insurance carrier can suggest the best coverage and rates for you and your lifestyle. Read More

Preparing Your Home and Your Family in the Event of a Wildfire

In some areas of the United States, regions that used to have designated “wildfire seasons” are finding that these seasons extend much longer – and in some cases, all year long. In recent years, we have seen some of the country’s most devastating wildfires ever, with significant loss of landscape, homes, and life. If you live in an area prone to wildfire, you should take steps to prepare your home and property to reduce fire risk. It’s also important to have a wildfire action plan.

Completing tasks such as brush removal and clearing gutters can be challenging to keep up with at any age. Particularly as we get older, it may become increasingly challenging to carry out these duties. It may also take more effort and time to evacuate. As a result, planning is critical.

Whether you are well-versed on what to do in the event of a wildfire, have experienced firsthand the impact of a wildfire, or have just moved to a wildfire-prone area, here are steps to take when preparing your home and family.

Keeping Your Home and Family Prepared for a Wildfire All Year Long

There are numerous critical steps to minimizing the risk of a wildfire reaching your home. CAL FIRE has everything you need to know to “get ready”.

Your Home

One of the most important steps you can take is to remove brush from the defensible space around your home. Defensible space is “…the buffer you create between a building on your property and the grass, trees, shrubs, or any wildland area that surround it. This space is needed to slow or stop the spread of wildfire and it protects your home from catching fire—either from direct flame contact or radiant heat. Defensible space is also important for the protection of the firefighters defending your home.” (CAL FIRE) It’s important to do this all year long to always be ready. If you are unsure about doing this yourself, you might consider finding a professional to help. Search in your area for brush removal services, or talk with a landscaper or tree service to see if they provide such services. Read More

5 Tips to Protect Your Possessions with Valuable Items Insurance Coverage

You may think that a homeowners insurance policy provides adequate coverage for all your valuables, but policies may provide limited or no coverage for certain items — including generally expensive items — that are damaged or stolen.

For example, many homeowners policies generally have a $1,000 or $1,500 coverage amount for jewelry if the loss is due to theft. Such limits are in place to help keep homeowners policies affordable. However, if jewelry valued at $2,000 is stolen from your home and you have a $1,000 policy limit, you can only receive $1,000 from your insurer to replace the missing items.

That is when an insurance endorsement (sometimes called a rider) can provide increased coverage for your possessions. For an additional premium, this coverage can help protect you from the loss of high-end valuables such as jewelry, furs, antiques, artwork and collectibles.

Here are five tips that may help you decide whether you need valuable items coverage.

1. Read Your Insurance Policy

Your insurance policy is a contract between you and your carrier. This document includes the limits of how much you will be compensated when certain valuable items are damaged or stolen. Note that certain items may not be covered, so be sure to carefully review your policy to determine whether you have insurance that meets your needs. If you have questions, contact your insurance agent.

2. Have Your Valuables Appraised

You may have possessions that are worth more than you think. To help you decide whether you need additional coverage, it may be helpful to have them appraised. An appraisal can help you determine if your homeowners insurance policy covers the full value of your property, as some items may not be covered. Read More

Why Do You Need Wedding Insurance?

The Wedding Protector Plan from Travelers helps couples protect their special day, which can be a significant financial investment. Hoping, planning and dreaming sometimes just isn’t enough. A wedding insurance policy can help protect you against the most common wedding insurance claims. For example, 40% of Travelers wedding claims in 2017 were due to vendor issues and 23% were due to weather problems. Sickness, wedding day accidents, military deployments and more account for the rest of potential wedding day claims. Explore the infographic to see how wedding insurance can help protect your big day. Read More

What to Do If Your Identity Is Stolen

The fastest-growing white-collar crime in the United States is identity fraud. ID fraud is when someone commits a crime or fraud in your name using your stolen personal information. No one, regardless of background or financial status, is immune to identity fraud and various cyber threats continue to grow with no sign of slowing down.

If your identity is stolen, it can affect your finances, credit history and reputation.

Take Action Immediately:

- Flag your credit reports. Contact the fraud department of one of the three major credit reporting agencies (Experian, Equifax and TransUnion). Tell them you are an identity theft victim. Ask them to place a “fraud” alert in your file and confirm that they will contact the other two companies.

- Get copies. Ask for a copy of the credit report. They are required to give you a free copy of your report if it is inaccurate because of fraud.

- Consider requesting a credit freeze. You might want to place a credit freeze on your credit file, which means that potential creditors cannot get your credit report. This makes it less likely that a potential identity thief can open accounts in your name. First, contact your state’s Attorney General’s office, then contact each credit reporting company.

- Contact creditors. Contact your creditors about any accounts that have been changed or opened fraudulently. Ask to speak with someone in the security or fraud department.

- File a report. File a report with your local police. Get a copy of the police report, so you have proof of the crime. Read More

Do You Need a Workplace Safety Committee

The general purpose of a safety committee is to minimize risk as well as ensure the safety and health of employees. While they can minimize the possibilities of hazard at your workplace, the question is – does your business need one?

Workplace safety committees are not a necessity for all businesses, but they can create a highly engaged, safe, work environment. So why should you consider a committee? Well, here is what they can bring to the table for your company.

What Is a Workplace Safety Committee?

For starters, a safety committee is a council comprised of members with representatives from labor functions as well as management teams who review, create, and refine procedures related to safety.

While it may seem that only industries that involve obvious dangers, like those involving heavy equipment, manufacturing, or chemical use, necessitate a safety committee, all industries can benefit from having an established body in place to proactively prevent unnecessary dangers.

Based on the type of company, a workplace safety committee serves many functions, including:

- Create workplace safety practices

- Conduct reviews and audits of the workplace

- Organize and lead safety training presentations

- Promote issues of employee interest related to health and safety

- Review incidents, potential incidents, accident reports and other documentation of challenges to refine policies and prevent reoccurrence

- Introduce a forum that allows for the discussion of safety issues on an as-needed basis

Who Needs a Workplace Safety Committee?

Regardless of whether your state requires organizations in your industry to have a workplace safety committee in place, these committees can be vital to maintaining and/or improving safety. The prevalence of accidents in the workplace attests to the importance of establishing a safety committee. According to the Bureau of Labor Statistics, 3 workers’ compensation claims are filed for every 100 full-time workers. As such, organizations of all industries can benefit from workplace safety committees. Read More

High-Tech Cars: What’s New in Car Safety Features?

High-tech cars are here to stay. Car safety technology is evolving quickly, bringing scores of often unpronounceable abbreviations for new systems that promise to keep us safer. Can a car read a street sign? Can the family wagon’s safety systems react to a sudden traffic change faster than a seasoned driver? Automakers say yes.

We’re all familiar with established safety systems like Anti-Lock Braking Systems (ABS) and Traction Control. ABS dates back to the late 1920’s when it was first developed for aircraft, although it wasn’t until 50 years later that this now nearly ubiquitous technology reached the highway. Technology is advancing faster now than ever before, bringing inventive new safety systems to your dashboard and automobile chassis. Let’s take a look under the hood of today’s high tech cars to see what some of the most intriguing new technologies offer and how they can make your commute safer and less stressful.

- What Are Advanced Driver Assistance Systems? Often referred to as ADAS, Advanced Driver Assistance Systems offer a broad range of safety-enhancing features for vehicles. These systems range from sensors that can detect drowsiness in drivers to pedestrian detection and avoidance systems — or even onboard cameras that can read road signs, warning you about speed limit changes or stop signs via dash alerts.

- Automatic Emergency Braking Systems (AEBS). Going a step beyond simpler and possibly distracting collision warning systems, AEBS puts the brakes on rear-end collisions. Sensors continually monitor the distance of vehicles in front of the car. If the system detects that a collision is imminent, it intervenes, assisting with braking if the driver is braking (but not hard enough) or automatically applying the vehicle’s brakes if the driver doesn’t respond. The National Highway Transportation Safety Administration (NHTSA) reports that up to a third of police-reported crashes involve a rear-end collision.1

- Lane Keeping Assist. Some of the leading reasons for lane-drift crashes are driver distraction, illness, and drivers who have drifted off themselves — and are sleeping at the wheel. Lane Keeping Assist raises the bar above Lane Departure Warning systems, which provide audible warnings and are often manually disabled by drivers, by taking corrective action to keep the vehicle centered in the lane. Read More

Driving in Fog Safely

Fog can be one of the most dangerous weather conditions for both new and experienced drivers. Fog has the potential to reduce visibility significantly, so it is critical that drivers stay focused on the road in order to stay safe. Severe weather demands your undivided attention, so be sure to reduce any possible distractions by turning the radio down or turning off that phone to keep your attention fully on the road. Keep in mind that sometimes the best driving decision you can make is to stay off the road completely until the weather clears.

3 Tips for Driving in Fog

1. Slow down. Driving at normal speeds in fog can be very dangerous. Be sure to slow down so you have more time to react if traffic stops or other hazards appear. When visibility is severely limited, find a safe place to park, away from travel lanes, and wait for conditions to improve.

2. Always headlights, never brights. Avoid using high-beam headlights in fog as fog consists of tiny water droplets that spread and reflect light. While your high beams are not useful in the fog, remember to turn on your low-beam headlights to help other drivers see you. Read More

Are you driving under the influence of your phone?

While there are many distractions on the road today, your mobile phone is one of the worst offenders. Take this quiz to test your knowledge about distracted driving and your phone.

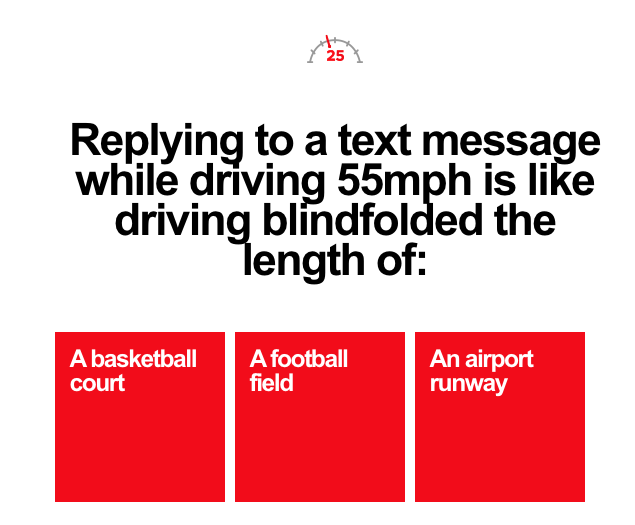

Replying to a text message while driving 55mph is like driving blindfolded the length of… Read More

Dangers of Distracted Driving

Distracted driving is any activity that could divert your attention away from the main task of driving.1 It is something that is both dangerous and disturbingly common. In fact, an estimated 660,000 drivers are using electronic devices while driving during daylight hours.2 You may be surprised to learn that cell phones and texting are just part of the problem when it comes to distracted driving. While stowing your phone while you drive is an important safety step, other behaviors behind the wheel, from drinking coffee to using a navigation system, may also be putting you at risk.

“The fact is, everything that occupies your mind or your vision can contribute to distraction behind the wheel,” explains Chris Hayes, Safety Professional from Travelers. “While many distracted driving studies focus on cell phones, any type of multi-tasking activity and driving simply do not mix.”

A list of driving distractions may include:

- Dialing or using a smartphone;

- Texting;

- Eating or drinking;

- Talking to passengers;

- Grooming;

- Reading;

- Programming a GPS or navigation system;

- Adjusting a radio or MP3 player.

-

Cognitive Distraction

It may not be surprising to learn that your brain is only capable of processing a certain amount of information at any given time.

When we attempt to perform multiple tasks at the same time, like driving while talking on the phone or eating, we can encounter performance problems. Multiple tasks tend to compete for our brain’s attention. Read more